Lower retail prices could stimulate consumer spending, providing a temporary boost to the economy. Moreover, these prices have a domino effect – from impacting producer decisions to swaying international trade relations. Retailers often use the retail vs cost retail inventory method to value inventory. In most retail businesses, you can see a clear pattern between the cost of products and their retail price. This enables retailers to convert retail prices to cost for inventory valuation purposes.

New approach to selecting KVCs and KVIs

In contrast, a perpetual inventory system like that used by QuickBooks Online will provide the number of units that should be in the ending inventory. You can then compare those units to the actual units on hand to determine inventory shrinkage. Retailers will inevitably have a physical count at the end of the year. Since the retail inventory method is just an estimation technique, expect that there will be differences in the physical count and retail method estimations. That’s the reason why the conventional method is also known as the “conservative approach”—it reports a lower income due to high COGS and lower assets due to a low ending inventory.

Cost vs. Price: What’s the Difference?

- The specific identification method of inventory costing applies primarily to high-ticket items, like automobiles.

- Their first step was to conduct a thorough cost audit, followed by an in-depth market research to understand the customers’ perception of their products’ value.

- Remember to consider the cost of everything that goes into your products, as production costs can also change on a regular basis.

- Most manufacturing or assembly organizations use the original cost of materials to report inventory.

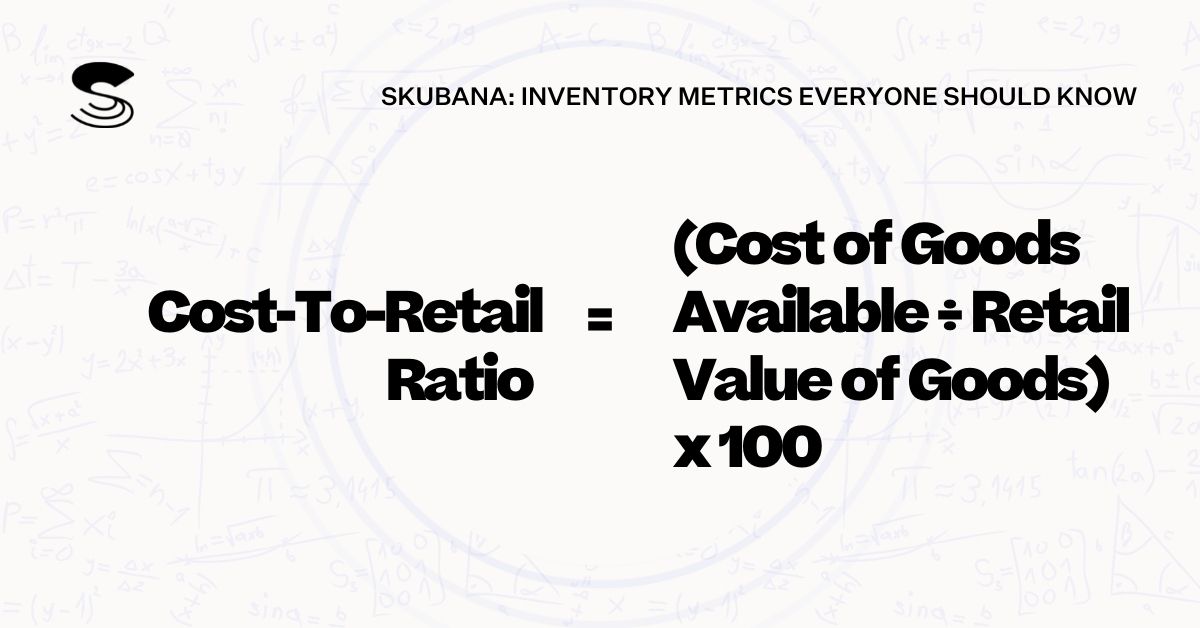

- The retail method is different — it values inventory based on the retail price of the inventory, reduced by the markup percentage.

A common element across these three questions is the role that categories and items play in the overall strategy. The first step is to identify the retailer’s KVCs—these are the categories that drive value perception the most and have a higher mix of KVIs. Then KVIs—the items that drive value perception the most—are identified. To optimize value perception, a retailer will price KVCs and KVIs most sharply relative to the relevant competition. Economists, academics, and retailers have long known that that shoppers recall prices only for a small number of items.

What Is the Retail Inventory Method?

The appropriate price of a product or service is based on supply and demand. The two opposing forces are always trying to achieve equilibrium, whereby the quantity of goods or services provided matches the market demand and its ability to acquire the goods or service. The concept allows for price adjustments as market conditions change.

Retailers, such as department stores, use the retail method of accounting since merchandise financial planning, price management and vendor negotiations all use mark-up as a key metric. Although cost accounting method can provide better accuracy, it usually requires more complex calculations. The main advantage of retail accounting is how easily it sets inventory prices to match what customers pay.

In accounting, a business must establish the cost basis of this inventory. Cost accounting is a more conservative inventory valuation method that values inventory based on its cost. Retail accounting, on the other hand, values inventory based on items’ retail price. When it comes to pricing products, there is a big difference between retail price vs selling price.

This approach makes the price seem significantly lower in the consumer’s mind. Retailers also use high-low pricing, setting prices high initially and then offering discounts, creating a perception of value and urgency to purchase. While there are many examples of brands that offer wholesale products, the pricing information isn’t always available. In fact, many brands have a vetting or application process—you’ll need to prove you’re the real deal before they’ll share their wholesale price list with you. So while you might make $2 profit per item, it might cost you more than $2 in overhead to sell that item—in which case you’ll need to adjust your wholesale pricing to make more profit.

These businesses design, manufacture, distribute, wholesale, and retail their own products. Although smaller than wholesale warehouses, storerooms are designed to replenish stock quickly on the shop floor. Shelf and rack storage on the shop floor focuses on presentation and accessibility. If you would like to see how Uphance can help you get your retail pricing strategy right, schedule a demo right away.

Not all KVIs will be KVIs across channels, and a variety of factors will drive items to move across KVI segments dynamically. Calculating the item level WAC is done using the same cost inputs as used under the retail method. The difference is each cost must be allocated to the item/location level.

These costs include things like rent, customer acquisition costs (CAC), utilities, fees to run your online store. Use this formula across your product range to summon a uniform and reasoned pricing approach. It’s also about shielding your business against future pitfalls or surprises. Since 2000, Choice beef prices have seen a consistent uptrend, with pork prices joining the rise in 2012. Remarkably, beef hit a peak retail price of $6.41 per pound in early 2015. The cost price will cover your time x hourly rate, your material, and marketing costs, but also overheads such as studio rent, telephone, and transport.

Valuing your markup accurately can utterly reshape your profit arena, allowing you to sustain, grow, and prosper your retail business. Market conditions wield an extraordinary power in determining both wholesale and retail prices. Inflation rates, economic forecasts, business competition, and customer buying behavior all weave into the complex tapestry of market conditions. Since there is no work in process –they only have finished goods — the FIFO, LIFO or weighted-cost methods are somewhat easier to compute. Major retailers, such as Wal-Mart and Target, have massive and diversified inventory items.